Choosing the right car insurance in Arizona involves understanding several key factors unique to the state. Arizona requires all drivers to have a minimum amount of liability insurance, which covers the costs of injury or damage to others in an accident for which the driver is found to be at fault. The state mandates minimum coverage limits of $25,000 per person for bodily injury, $50,000 per accident for bodily injury, and $15,000 in property damage liability. However, it is often advisable for drivers to consider additional coverage options to ensure comprehensive protection. Factors such as age, driving history, and the type of vehicle can affect premiums, making it important for consumers to shop around and compare quotes from various insurers to find the best fit for their needs and budget.

Toc

- 1. Understanding Arizonas Car Insurance Requirements

- 2. Factors Affecting Car Insurance Rates in Arizona

- 3. Top Car Insurance Companies in Arizona

- 4. Related articles 01:

- 5. Tips for Saving Money on Car Insurance in Arizona

- 6. Additional Considerations for Young Drivers in Arizona

- 7. Related articles 02:

- 8. FAQ

- 9. Finding the Best Car Insurance in Arizona

Understanding Arizonas Car Insurance Requirements

While Arizona has mandatory liability insurance requirements, there are also other optional coverages that drivers can consider. These include collision coverage, which protects against damages to their own vehicle in an accident, and comprehensive coverage, which covers non-collision related damages such as theft or weather damage.

However, it’s important for drivers to understand that these additional coverages will come at a higher cost. Therefore, it’s crucial to carefully evaluate one’s personal needs and financial situation when choosing the right car insurance policy.

Importance of Uninsured/Underinsured Motorist Coverage

In Arizona, it’s also wise to consider uninsured/underinsured motorist coverage. This type of insurance provides protection if you’re involved in an accident with a driver who either lacks insurance or has insufficient coverage to pay for the damages. This coverage is particularly valuable in cases where the other driver is at fault and doesn’t have enough insurance to cover your damages. Given that a significant number of drivers on the road may not carry adequate insurance, having this additional layer of protection can save you from substantial financial burdens.

The Benefits of Comprehensive Coverage

While meeting the minimum requirements is essential, it’s important to recognize that these coverages often do not reflect the true costs associated with accidents or vehicle repairs. Investing in comprehensive coverage may incur higher premiums, but it can save you from significant out-of-pocket expenses in the event of an accident. Comprehensive coverage can also cover damages caused by events like hailstorms, floods, and even acts of vandalism. Additionally, some lenders require comprehensive coverage if you are financing your vehicle, further emphasizing its importance.

Shopping Around for the Best Deal

As with any type of insurance, it’s beneficial to shop around and compare quotes from different providers to find the best deal. In Arizona, there are many insurance companies to choose from, so it’s essential to do your research and gather multiple quotes before making a decision. Factors such as age, driving record, and even credit score can affect premiums, so be sure to provide accurate information when requesting quotes.

Factors Affecting Car Insurance Rates in Arizona

When it comes to car insurance rates in Arizona, several factors can significantly impact your premiums. Understanding these factors can help you make informed decisions when selecting coverage.

Age and Driving Experience

Your age and driving experience are two of the most influential factors in determining your car insurance rates. Young drivers, particularly those under the age of 25, often face higher premiums due to their perceived higher risk. Insurers typically rely on statistical data indicating that younger drivers are more likely to be involved in accidents. For instance, a young driver with a clean driving record might receive a discount, while a driver with multiple accidents could see a significant increase in their rates.

Driving History

Your driving history plays a crucial role in shaping your insurance rates. A clean driving record with no accidents or traffic violations can lead to lower premiums, while a history of accidents or tickets can result in higher costs. To keep your rates manageable, focus on safe driving practices and consider taking a defensive driving course to improve your skills.

Credit Score

In Arizona, many insurance companies use your credit score as a factor in determining your premiums. Good credit can often mean lower insurance premiums, as insurers view individuals with good credit as less risky. If your credit score is low, consider taking steps to improve it, such as paying off debts and making timely payments on existing accounts.

Vehicle Type and Location

The type of vehicle you drive can also affect your insurance rates. High-performance cars or vehicles with a history of theft may incur higher premiums. Additionally, your location within Arizona can impact your rates; for example, the bustling city streets of Phoenix might lead to higher premiums than the tranquil countryside of Sedona due to higher traffic congestion and accident rates.

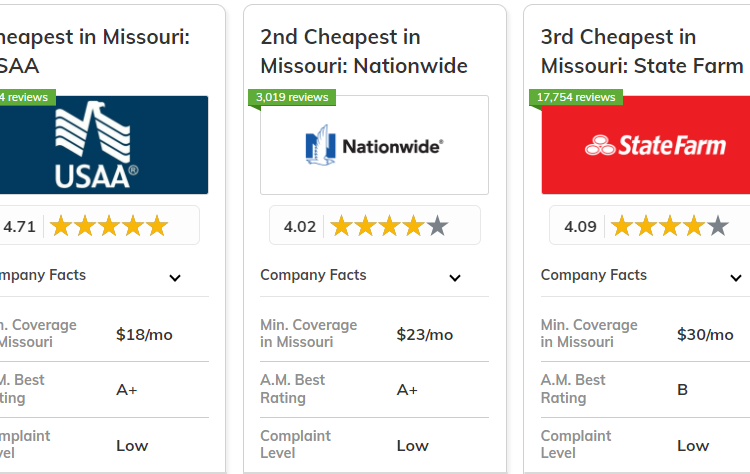

Top Car Insurance Companies in Arizona

Navigating the car insurance market in Arizona can be overwhelming, but several providers stand out as top options for young drivers. Here’s a closer look at some of the best car insurance companies in Arizona:

Geico

Geico is renowned for its affordable rates and extensive range of discounts, making it an attractive choice for young Arizona drivers. The company offers minimum liability coverage starting around $43 per month, while full coverage policies average around $122 per month. Geico’s discounts, including good student, safe driver, and multi-vehicle discounts, can help young drivers save significantly on their premiums.

Geico also provides a user-friendly mobile app that allows policyholders to manage their accounts, file claims, and access digital insurance cards, making it a convenient option for busy drivers. Additionally, Geico is leveraging AI and machine learning to personalize quotes and offer more accurate risk assessments, enhancing the customer experience.

1. https://fordlangha.com.vn/archive/1575/

2. https://fordlangha.com.vn/archive/1576/

3. https://fordlangha.com.vn/archive/1574/

State Farm

As the largest auto insurer in the United States, State Farm offers comprehensive coverage options and competitive rates for young drivers in Arizona. The company’s average full coverage policy costs approximately $240 per month, which is slightly higher than some competitors but is balanced by a wide range of benefits. State Farm features accident forgiveness, which means your first accident won’t necessarily lead to a rate increase, and roadside assistance for peace of mind during emergencies.

State Farm’s robust network of agents can also provide personalized service and tailored coverage options, making it a solid choice for those seeking a more hands-on insurance experience.

Allstate

Allstate is another top contender for young drivers in Arizona, with a strong reputation and a variety of discount opportunities. The company’s average full coverage policy costs around $130 per month, and it offers features like the Drivewise app, which can help you earn discounts based on your safe driving habits.

Allstate’s 24/7 customer support and user-friendly mobile app enhance the overall experience, allowing policyholders to manage their coverage easily. Additionally, Allstate provides a unique benefit called “Claim Satisfaction Guarantee,” which promises a refund if you’re not satisfied with the claims process.

USAA

While USAA’s car insurance services are exclusive to military members, veterans, and their families, it’s worth considering if you or a family member qualify. USAA offers competitive rates, with full coverage policies averaging around $188 per month. The company is known for its exceptional customer service and wide range of discounts, including those for good students and safe drivers.

USAA also provides additional features such as rental car reimbursement and roadside assistance, making it an attractive option for those eligible for membership.

Tips for Saving Money on Car Insurance in Arizona

As a young driver in Arizona, there are several strategies you can employ to save money on your car insurance premiums:

Compare Quotes from Multiple Insurers

Shopping around and comparing quotes from different providers is crucial for finding the best car insurance in Arizona. Rates can vary significantly between companies, so take the time to explore options and find the best deal for your needs. Online comparison tools can make this process easier and more efficient.

Take Advantage of Discounts

Many insurers offer discounts for young drivers, such as good student, safe driver, and multi-policy discounts. Be sure to ask your provider about any available savings opportunities. For example, maintaining a B average or higher in school may qualify you for a good student discount.

Increase Your Deductible

Raising your deductible can lower your monthly premiums, but be mindful of your ability to cover the higher out-of-pocket costs in the event of a claim. If you have a clean driving record and believe you can manage the risk, increasing your deductible may be a smart way to save on your monthly payments.

Maintain a Clean Driving Record

Avoiding accidents and traffic violations can have a significant impact on your insurance rates. Practice safe driving habits, such as obeying speed limits and avoiding distractions, to keep your record clean and your premiums low. If you do receive a ticket or are involved in an accident, consider taking a defensive driving course to potentially mitigate the impact on your rates.

Consider a Lower-Risk Vehicle

Choosing a vehicle with a good safety rating and lower repair costs can help you save on your car insurance in Arizona. Research insurance costs associated with various makes and models before purchasing a vehicle, as some cars are inherently more expensive to insure than others.

Utilize Telematics Programs

Some insurers offer telematics programs that track your driving behavior through a mobile app or device installed in your vehicle. If you demonstrate safe driving habits, such as maintaining a consistent speed and avoiding hard braking, you may qualify for additional discounts. This option is particularly appealing for young drivers looking to lower their premiums.

Explore Usage-Based Insurance Programs

The increasing popularity of usage-based insurance (UBI) programs in Arizona offers another way for young drivers to save. UBI programs use telematics devices to track driving habits and offer discounts based on safe driving behavior. If you are a responsible driver, you may find that these programs can significantly lower your insurance costs.

Additional Considerations for Young Drivers in Arizona

Understand the Consequences of Driving Without Insurance

In Arizona, driving without the minimum required insurance coverage is illegal and can result in severe penalties, including fines, license suspension, and even the impoundment of your vehicle. It’s crucial to maintain the necessary coverage to avoid these consequences and protect yourself financially.

Take a Defensive Driving Course

Many insurance providers in Arizona offer discounts to young drivers who complete a defensive driving course. These courses teach valuable skills and techniques that can help you become a safer, more responsible driver, potentially leading to lower insurance rates.

1. https://fordlangha.com.vn/archive/1571/

2. https://fordlangha.com.vn/archive/1572/

3. https://fordlangha.com.vn/archive/1574/

Explore Alternative Coverage Options

While traditional car insurance policies are the most common choice, there are alternative coverage options worth considering, such as pay-per-mile insurance. These innovative plans can provide more affordable coverage for young drivers who don’t rack up high mileage. If you primarily use your vehicle for short trips or infrequent travel, this option may be a cost-effective solution.

Consider Your Future Driving Goals

As you navigate the world of car insurance as a young driver, it’s important to consider your long-term driving goals. If you plan to pursue a career that requires a lot of driving, such as ridesharing or delivery services, you may need to adjust your coverage accordingly to ensure you’re properly protected.

FAQ

Q: What is the best way to get a car insurance quote in Arizona?

A: The best way to get a car insurance quote in Arizona is to use online comparison tools or contact insurance agents directly. This allows you to compare rates from multiple providers and find the best coverage for your needs and budget.

Q: How can I get a good student discount on my car insurance?

A: To qualify for a good student discount on your car insurance in Arizona, you’ll typically need to maintain a certain GPA, usually a B average or higher. Be sure to ask your insurer about their specific requirements for this discount.

Q: What are some ways to improve my driving record and lower my insurance rates?

A: To improve your driving record and potentially lower your car insurance rates in Arizona, focus on driving safely, avoiding speeding tickets and accidents, and consider taking a defensive driving course. Maintaining a clean driving record is one of the most effective ways to secure lower premiums.

Q: How can I find affordable car insurance if I have a limited driving history or a poor credit score?

A: If you have a limited driving history or a poor credit score, it’s important to shop around and compare quotes from multiple insurers. Some providers, like Geico and USAA, may offer more favorable rates for young drivers in these situations. Additionally, consider taking a defensive driving course, which can help offset the higher risk associated with your driving profile.

Q: What are the consequences of driving without insurance in Arizona?

A: Driving without insurance in Arizona is illegal and can result in severe penalties, including fines, license suspension, and the impoundment of your vehicle. It’s essential to maintain the necessary coverage to avoid these consequences and protect yourself financially.

Finding the Best Car Insurance in Arizona

Finding the best car insurance in Arizona requires research, comparison, and taking advantage of available discounts. By understanding the minimum coverage requirements, exploring top-rated insurance providers, and implementing the tips provided in this guide, you can secure affordable coverage that meets your needs.

As you continue to gain experience behind the wheel, remember to stay vigilant, maintain a clean driving record, and explore alternative coverage options that may become more accessible over time. With the right approach, you can find the best car insurance in Arizona that not only meets your current needs but also sets you up for long-term financial security on the road. Start comparing quotes today and find the best auto insurance in Arizona that fits your lifestyle and budget.

Leave a Reply