Choosing the right insurance for your small business can be overwhelming, given the vast array of options. Next Insurance has become a popular choice for entrepreneurs seeking affordable and convenient coverage. To make an informed decision, it’s essential to examine next insurance reviews and understand the specifics of their offerings and customer experiences.

Toc

- 1. Comprehensive Coverage Options

- 1.1. Workers’ Compensation Insurance: Protecting Your Employees and Business

- 1.2. Commercial Auto Insurance: Safeguarding Your Vehicles and Business

- 1.3. Commercial Property Insurance: Securing Your Business Assets

- 1.4. Hired & Non-Owned Auto Insurance: Coverage for Employee Travel

- 1.5. Liquor Liability Insurance: Protecting Alcohol-Serving Businesses

- 1.6. Tools & Equipment Insurance: Protecting Essential Tools

- 2. Next Insurance Reviews: Affordability and Value

- 3. Related articles 01:

- 4. Digital Convenience and User-Friendliness

- 5. Customer Experience and Reviews

- 6. Next Insurance vs- Competitors

- 7. Is Next Insurance Right for You?

- 8. Related articles 02:

- 9. Frequently Asked Questions

- 10. Conclusion

Comprehensive Coverage Options

One of the most compelling aspects highlighted in Next Insurance reviews is the extensive range of insurance products available. Unlike many providers that offer only basic policies, Next Insurance provides a diverse selection tailored to the unique requirements of small businesses. Here’s a closer look at the key coverage options:

Workers’ Compensation Insurance: Protecting Your Employees and Business

This policy is essential for businesses that employ workers, as it protects against financial losses resulting from employee injuries or illnesses that occur on the job. Workers’ compensation insurance ensures that employees receive the necessary medical care, rehabilitation services, and compensation for lost wages due to work-related injuries. Additionally, it shields the business from potential lawsuits by providing legal defense and coverage for claims made by injured employees, fostering a safer and more secure workplace environment.

Commercial Auto Insurance: Safeguarding Your Vehicles and Business

If your business owns vehicles, this insurance covers damages and liabilities resulting from accidents involving those vehicles. Commercial auto insurance is crucial for protecting your business assets, as it covers repair costs, medical expenses, and legal fees that may arise from accidents. Moreover, it ensures that you are compliant with state and federal legal requirements, allowing your business to operate smoothly without the risk of facing hefty fines or legal challenges.

Commercial Property Insurance: Securing Your Business Assets

This policy safeguards your business assets, including equipment, inventory, and physical buildings, from damage or theft. Commercial property insurance is essential for protecting your business against unforeseen events such as natural disasters, fire, or vandalism. It provides financial assistance for repairs or replacement, helping businesses recover quickly and minimizing disruptions to operations. For companies that rely on tangible assets for their operations, having this coverage can be a critical factor for long-term success.

Hired & Non-Owned Auto Insurance: Coverage for Employee Travel

For businesses where employees use personal vehicles for work purposes, this insurance provides liability coverage in case of an accident. This coverage is particularly beneficial for companies that rely on travel for business activities, such as sales representatives or consultants who frequently meet clients off-site. Hired & non-owned auto insurance protects your business from potential financial liability stemming from accidents that occur while employees are using their personal vehicles or rented vehicles for company-related tasks.

Liquor Liability Insurance: Protecting Alcohol-Serving Businesses

If your business involves the sale or service of alcoholic beverages, this coverage protects against claims arising from incidents related to alcohol consumption, such as accidents or injuries. Liquor liability insurance is vital for bars, restaurants, and any establishment where alcohol is served, as it covers legal fees, medical expenses, and damages resulting from alcohol-related incidents. This insurance not only mitigates financial risk but also enhances the reputation of your business by demonstrating a commitment to responsible service.

Tools & Equipment Insurance: Protecting Essential Tools

This policy protects specialized tools and equipment from loss or damage while in use or during transit. For businesses in construction, landscaping, and similar industries, tools and equipment are vital for operations, and any loss can lead to significant financial setbacks. Tools & equipment insurance covers various risks, including theft, fire, and accidental damage, ensuring that businesses can quickly replace or repair essential tools without incurring crippling costs. This coverage is an important consideration for maintaining productivity and supporting ongoing projects.

These diverse coverage options empower small business owners to customize their insurance policies according to their specific industry needs. By tailoring their coverage, businesses can ensure that they only pay for what they require, effectively managing risk while protecting their employees, assets, and overall operations. It’s crucial for business owners to assess their unique circumstances and consult with insurance professionals to determine the best policies for their needs.

Next Insurance Reviews: Affordability and Value

When it comes to affordability, Next Insurance stands out in the crowded marketplace, as reflected in numerous Next Insurance reviews. The company’s digital-first approach allows them to minimize overhead costs associated with traditional insurance providers. As a result, they can offer competitive pricing that can lead to significant savings for small businesses.

According to a 2023 study by a reputable source, the average cost of general liability insurance for small businesses in the United States is around $500 per year. Next Insurance’s pricing often falls within this range, with some customers reporting savings of up to 30% compared to traditional insurers. On average, small business owners can expect to pay between $700 and $3,800 annually for their Next Insurance policies. This range is influenced by various factors, including the type of business, the level of coverage, and geographical location.

Additionally, Next Insurance offers several discounts to enhance affordability, including:

- Bundling Discounts: Save by purchasing multiple policies together.

- Annual Payment Discounts: Lower costs by paying your premium annually instead of monthly.

- Safety-Related Discounts: Businesses with strong risk management practices may qualify for additional savings.

The combination of competitive pricing and available discounts makes Next Insurance a compelling option for small business owners looking to optimize their insurance expenses.

1. https://fordlangha.com.vn/archive/1575/

2. https://fordlangha.com.vn/archive/1574/

3. https://fordlangha.com.vn/archive/1573/

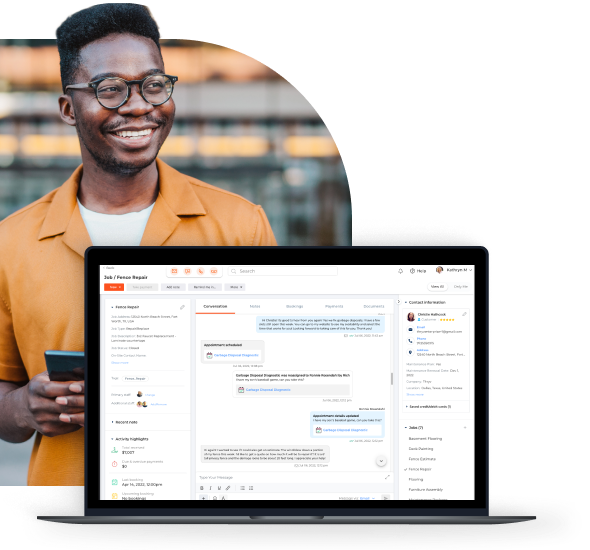

Digital Convenience and User-Friendliness

The user experience is a significant focus in Next Insurance reviews, and the feedback is overwhelmingly positive. The company’s digital-first model facilitates a seamless experience for managing business insurance.

Quick Quote Process: Streamlined and Efficient

Obtaining a quote is straightforward and can be completed in just a few minutes through the Next Insurance website or mobile app. For example, a restaurant owner in New York was able to receive a customized quote for their general liability and workers’ compensation insurance in under five minutes through the Next Insurance app. This streamlined process allowed them to quickly compare coverage options and make an informed decision.

Certificate of Insurance (COI): Instant Proof of Coverage

Once the desired policy is selected, users can instantly download a certificate of insurance (COI), which is essential for providing proof of coverage to clients or regulatory bodies. This feature significantly enhances the convenience factor for small business owners.

Intuitive Dashboard: Manage Your Policies with Ease

Next Insurance also offers an intuitive dashboard for ongoing policy management. This centralized hub allows users to easily view coverage details, make adjustments, pay premiums, and file claims without the need for lengthy phone calls or in-person appointments. This level of accessibility and convenience is highly valued by busy small business owners.

Customer Experience and Reviews

Customer feedback plays a crucial role in evaluating any service, and Next Insurance has received high marks across various platforms. The company has built a reputation for exceptional customer service and support, as reflected in its impressive 4.7 out of 5-star rating on Google.

Multiple Support Channels: Accessible Assistance

Next Insurance provides several channels for customer assistance, including phone, email, and online chat. Their representatives are available during extended business hours, making it easy for customers to get help when needed.

Responsiveness and Expertise: A Commitment to Satisfaction

Next Insurance emphasizes a customer-centric approach, offering 24/7 online support and a dedicated team of insurance specialists available by phone or email. This commitment to accessibility and personalized assistance has contributed to its consistently high customer satisfaction ratings. Customers frequently highlight the responsiveness and expertise of the Next Insurance support team in their reviews. Many small business owners appreciate the ease with which issues can be resolved, contributing to overall satisfaction with the service.

While the majority of customer reviews are positive, some isolated negative comments have been noted. These often relate to specific policy limitations rather than systemic issues, and they do not significantly detract from the overall positive sentiment surrounding the company.

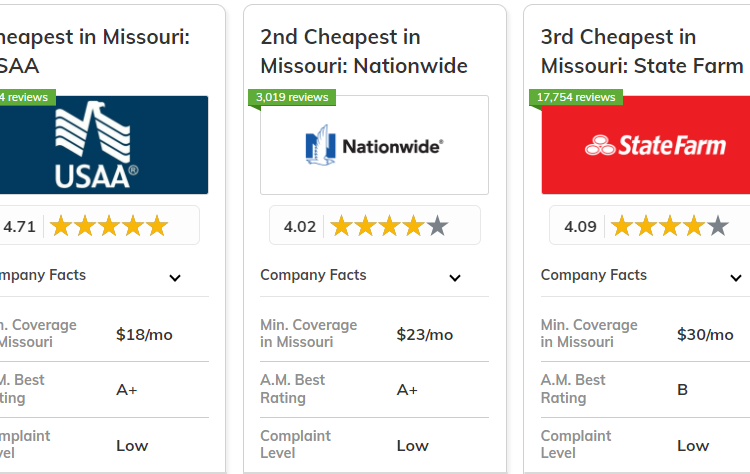

Next Insurance vs- Competitors

When comparing Next Insurance to other small business insurance providers, several key differentiators emerge that are worth noting in any comprehensive Next Insurance review.

Affordability and Customization: Tailored to Your Needs

Next Insurance consistently offers competitive rates that are often more flexible than those provided by traditional insurers. The ability to tailor coverage according to specific business needs is a significant advantage.

Digital Experience: A Modern Approach

The fully digital platform of Next Insurance sets it apart from traditional providers that often rely on in-person interactions. This digital convenience makes managing insurance easier and more efficient for small business owners.

Specialized Coverage: Meeting Unique Requirements

While many insurers focus primarily on standard general liability and professional liability policies, Next Insurance offers unique coverage options like hired & non-owned auto insurance and liquor liability coverage. This specialized focus can be particularly beneficial for certain business types.

Lack of Local Agents: A Consideration for Some

A potential drawback of Next Insurance’s digital-first approach is the absence of local agents. Some small business owners may prefer the personalized service that comes with having a local insurance agent who can provide tailored advice and support. While Next Insurance often offers competitive rates, it’s important to note that some traditional insurers may offer lower premiums for certain types of businesses, especially those with complex insurance needs or a history of claims. It’s always advisable to compare quotes from multiple providers before making a decision.

Ultimately, the choice between Next Insurance and its competitors will depend on the specific needs and preferences of each business. However, the combination of affordability, extensive coverage options, and a user-friendly digital platform makes Next Insurance a strong contender for many entrepreneurs.

Is Next Insurance Right for You?

1. https://fordlangha.com.vn/archive/1573/

2. https://fordlangha.com.vn/archive/1574/

3. https://fordlangha.com.vn/archive/1575/

Based on the insights gathered from various Next Insurance reviews, it is clear that the company offers numerous benefits for small business owners. The affordability, convenience, and comprehensive coverage options make it an attractive choice for a wide range of industries, including e-commerce, professional services, restaurants, and construction.

However, businesses with complex insurance needs, a large workforce, or a preference for working with local agents may find that alternative providers better suit their requirements. To make an informed decision, it is advisable for small business owners to obtain a free quote from Next Insurance and explore the coverage options available. This proactive approach will allow you to assess whether Next Insurance aligns with your specific business insurance needs.

Frequently Asked Questions

Q1: What is the average cost of Next Insurance for small businesses?

A: The average cost typically ranges from $700 to $3,800 per year, depending on factors such as the type of business, coverage level, and location.

Q2: How do I file a claim with Next Insurance?

A: Filing a claim is straightforward through the company’s website or mobile app, where you can provide details and any necessary supporting documentation.

Q3: Does Next Insurance offer discounts for small businesses?

A: Yes, Next Insurance provides various discounts, including bundling, annual payment, and safety-related discounts.

Q4: What are some of the limitations of Next Insurance?

A: Next Insurance lacks a network of local agents, which may be a drawback for some small business owners. Additionally, its digital-first approach may not be ideal for businesses with complex insurance needs or a large number of employees.

Conclusion

In conclusion, Next Insurance has established itself as a leading provider of small business insurance in the United States. With a comprehensive range of coverage options, competitive pricing, and a user-friendly digital platform, it offers a compelling value proposition for entrepreneurs seeking to protect their assets and operations.

Whether you are a new business owner or an established enterprise, taking the time to explore the insurance solutions offered by Next Insurance is worthwhile. By obtaining a personalized quote and comparing it to your current coverage, you can determine if Next Insurance is the right fit for your small business’s unique insurance needs.

Leave a Reply