Navigating the complex world of car insurance in Virginia can be daunting, especially when faced with a plethora of options and fluctuating rates. While finding the cheapest policy might seem like the ultimate goal, securing the best car insurance in Virginia often involves a more nuanced approach, considering factors like coverage, customer service, and financial stability.

Toc

- 1. Understanding Virginia Car Insurance Requirements

- 2. Top Car Insurance Companies for the Best Car Insurance in Virginia

- 3. Related articles 01:

- 4. Factors Affecting Car Insurance Costs in Virginia

- 5. Tips for Saving Money on Virginia Car Insurance

- 6. Related articles 02:

- 7. Frequently Asked Questions

- 8. Conclusion

Understanding Virginia Car Insurance Requirements

When searching for the best auto insurance in Virginia, it’s crucial to understand the state’s minimum car insurance requirements. Virginia mandates that all drivers maintain a minimum liability coverage of $30,000 for bodily injury per person, $60,000 per accident, and $20,000 for property damage, commonly referred to as 30/60/20 coverage. Notably, these limits will increase to 50/100/25 starting January 1, 2025. This increase reflects rising healthcare costs and the need to ensure sufficient compensation for accident victims, thereby enhancing protection for all road users.

While meeting the minimum requirements is essential for legal driving, many drivers opt for full coverage. Full coverage typically includes collision and comprehensive insurance alongside liability coverage, offering more extensive protection in the event of an accident. This additional coverage can be a lifesaver, covering repairs to your vehicle and providing peace of mind. However, some drivers may prefer minimum coverage for financial reasons, especially if they own older vehicles or have limited financial resources.

It’s also important to note that Virginia will no longer allow drivers to pay a $500 uninsured motorist fee in lieu of insurance, effective July 1, 2024. This change makes it imperative for all Virginia drivers to secure car insurance to legally operate a vehicle.

Top Car Insurance Companies for the Best Car Insurance in Virginia

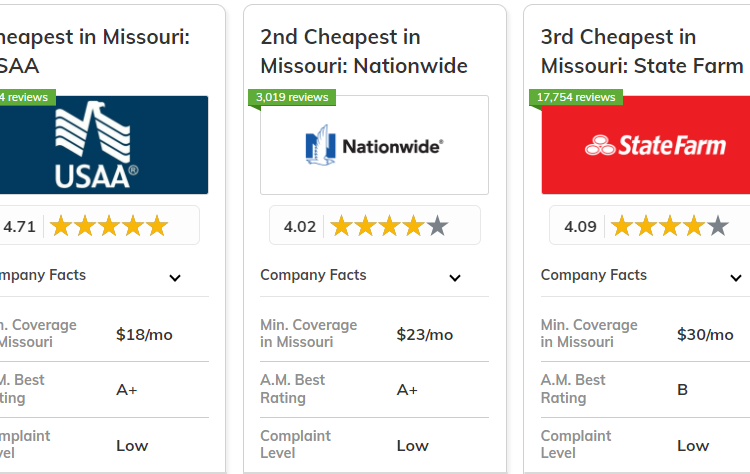

When evaluating the best car insurance in Virginia, several companies consistently stand out for their affordability, coverage options, and customer satisfaction. Here’s a closer look at some of the top contenders:

Erie Insurance

Erie Insurance is frequently regarded as one of the best auto insurance providers in Virginia, thanks to its competitive rates and comprehensive coverage options. On average, a minimum coverage policy from Erie costs around $38 per month, while full coverage averages about $91 monthly, significantly lower than the state averages. Erie also offers a variety of discounts, such as those for safe drivers, good students, and households with multiple vehicles. Additionally, their “Erie Drive Safe” program rewards safe drivers with discounts, further enhancing their appeal.

Pros:

- Affordable rates for both minimum and full coverage

- Extensive range of coverage options

- Generous discounts available, including the Erie Drive Safe program

Cons:

- Limited availability in some regions of Virginia

USAA

USAA is highly esteemed among Virginia drivers, though it’s exclusively available to active and former military members and their families. Known for its exceptional customer service and financial stability, USAA offers competitive rates and specialized discounts tailored to military personnel. While the average costs can vary, the added benefits make it a top choice for eligible drivers seeking the best auto insurance in Virginia.

Pros:

- Outstanding customer service and financial stability

- Competitive rates with specialized discounts for military families

- Wide array of coverage options

Cons:

- Eligibility limited to military members and their families

Travelers

Travelers is another solid choice for car insurance in Virginia, recognized for its strong financial footing and commitment to customer satisfaction. With average costs of about $100 per month for full coverage, Travelers also provides a variety of coverage options and discounts, making it a viable choice for many drivers.

Pros:

- Strong financial stability and good customer service

- Competitive rates and diverse coverage options

Cons:

- May not be the cheapest option for all drivers

Virginia Farm Bureau

As a local insurance provider, Virginia Farm Bureau has earned a solid reputation among Virginia residents. Focused on offering affordable car insurance to Virginia residents, the company averages about $42 per month for minimum coverage and $98 for full coverage. Virginia Farm Bureau emphasizes community involvement and a commitment to customer satisfaction, making it a trustworthy choice for local drivers.

2. https://fordlangha.com.vn/mmoga-the-best-pet-insurance-for-multiple-pets-a-practical-guide

3. https://fordlangha.com.vn/mmoga-best-car-insurance-in-arizona-find-affordable-coverage-for-you

5. https://fordlangha.com.vn/mmoga-the-best-car-insurance-in-nc-affordable-coverage-for-young-drivers

Pros:

- Competitive rates, particularly for full coverage

- Strong local presence and community involvement

- Dedicated to providing value to Virginia drivers

Cons:

- May not have the same recognition as national insurance brands

State Farm

State Farm, a well-known national insurance provider, offers competitive rates in Virginia, averaging $38 per month for minimum coverage and $104 for full coverage. With a broad range of discounts and a commitment to customer service, State Farm remains a popular choice among drivers seeking the best car insurance in Virginia.

Pros:

- Competitive rates, particularly for minimum coverage

- Extensive range of discounts available

- Strong brand recognition and customer service

Cons:

- May not be the most affordable option for every driver.

Overall, finding the best auto insurance in Virginia will depend on individual needs and preferences. By understanding the state’s minimum requirements and exploring different coverage options and providers, drivers can make informed decisions to find the most suitable car insurance for their unique circumstances. Additionally, regularly comparing rates and reviewing coverage can help ensure continued protection at the best possible price. So, it is always important to keep yourself updated with the latest trends in car insurance policies of Virginia.

Factors Affecting Car Insurance Costs in Virginia

Several key factors can influence the cost of car insurance in Virginia, making it essential to understand how these elements may affect your premiums:

Driving Record

One of the most significant factors in determining your car insurance rates is your driving record. A clean record free from accidents, speeding tickets, or DUI convictions can lead to lower premiums, often resulting in substantial savings over time. Insurers view responsible driving as a strong indicator of risk, so maintaining a positive driving history can not only keep your costs down but also qualify you for additional discounts. Conversely, violations can substantially increase your costs. For example, an average speeding ticket can raise rates by approximately 22%, while being involved in an at-fault accident can spike premiums by around 51%. A DUI conviction is particularly severe, potentially increasing rates by a staggering 85%. This highlights the importance of safe driving practices for both your safety and your wallet.

Age

Age plays a crucial role in car insurance pricing, reflecting the statistical trends associated with different age groups. Young drivers, particularly those under 25, typically face insurance rates that are 20% higher than those of older drivers due to their increased risk of accidents and lack of driving experience. This age-related risk is backed by data indicating that younger drivers are more likely to engage in risky behaviors, such as speeding or distracted driving. As drivers gain experience and age, their rates generally decrease, reflecting their lower risk profile and more responsible driving habits. This means that, over time, consistent, cautious driving can lead to significant savings on insurance premiums.

Vehicle

The make, model, and year of your vehicle significantly impact your insurance costs. Insurers evaluate a variety of factors when determining premiums, including safety features, theft risk, and repair expenses associated with specific vehicles. For instance, cars equipped with advanced safety technology such as automatic braking systems or lane departure warnings may qualify for lower rates. Additionally, vehicles that are more prone to theft or have higher repair costs can lead to increased insurance premiums. Generally, newer and more expensive vehicles tend to incur higher insurance rates. However, it’s worth noting that some older models with a strong safety record may offer lower insurance costs, making it beneficial to consider both safety ratings and insurance implications when purchasing a vehicle.

Location

Your geographical location within Virginia can also significantly influence your car insurance premiums. Factors such as local traffic patterns, accident history, and crime levels are all taken into account by insurers. For instance, areas with high traffic congestion and frequent accidents may see higher premiums, as the likelihood of a claim increases. Urban drivers typically pay higher premiums than those in rural areas due to these increased risks. Additionally, certain neighborhoods with higher rates of vehicle theft may also affect insurance costs. It’s essential to understand how your specific location impacts your insurance rates and to shop around, as premiums can vary significantly between different areas.

Credit Score

In Virginia, your credit score can also have a noteworthy effect on your car insurance rates. Insurance companies use credit scores as a proxy for risk assessment, relying on the correlation between credit history and the likelihood of filing claims. Those with lower credit scores might be perceived as more likely to file claims, resulting in higher premiums compared to individuals with excellent credit ratings. This makes it crucial for drivers to be aware of their credit health and consider measures to improve it, as doing so could ultimately lead to reduced insurance costs. Maintaining a good credit score can not only benefit your insurance premiums but also help in securing loans and other financial products.

Artificial Intelligence Impact

The growing use of artificial intelligence (AI) in car insurance pricing is also noteworthy and represents a new frontier in how insurers assess risk. AI algorithms can analyze vast amounts of data, from driving behavior to environmental factors, to predict risk and personalize insurance rates more accurately than traditional methods. This technological advancement allows insurers to offer more tailored policies, potentially benefiting consumers by providing rates that reflect their individual risk profiles. Furthermore, as AI technology continues to evolve, it may lead to a more competitive insurance market in Virginia, encouraging companies to innovate and offer better coverage options as they harness data-driven insights to assess risk more effectively.

Tips for Saving Money on Virginia Car Insurance

Finding the best auto insurance in Virginia doesn’t have to break the bank. Here are some practical tips to help you save money on your car insurance premiums:

Compare Quotes:

Regularly comparing quotes from multiple insurance providers is one of the most effective ways to save money on car insurance. It allows you to see varying rates and coverage options, and switch to a more cost-effective plan if necessary. Utilize comparison websites or consult with an independent insurance agent to simplify this process.

Bundle Policies:

Consider bundling your car insurance with other types of insurance policies, such as homeowners or renters insurance. Many companies offer significant discounts for bundling, which can substantially reduce your overall insurance costs.

2. https://fordlangha.com.vn/mmoga-the-best-pet-insurance-for-multiple-pets-a-practical-guide

4. https://fordlangha.com.vn/mmoga-best-car-insurance-in-arizona-find-affordable-coverage-for-you

Maintain a Clean Driving Record:

As previously mentioned, a clean driving record is crucial for keeping insurance premiums low. Avoiding accidents, traffic violations, and DUI convictions can prevent rate hikes and, in some cases, earn you safe driver discounts from your insurer.

Increase Deductibles:

Opting for a higher deductible is another strategy to lower your monthly insurance premium. This means you’ll pay more out-of-pocket in the event of a claim, but can result in significant savings on your monthly payments.

Take Advantage of Discounts:

Inquire about available discounts with your insurer. Many companies offer discounts for affiliations with certain organizations, completing defensive driving courses, having a vehicle equipped with safety features, or being a good student.

Improve Your Credit Score:

Since credit scores impact insurance rates in Virginia, working to improve your credit can lead to lower premiums. Paying bills on time, reducing debt, and regularly checking your credit report for errors can help boost your score.

Review Your Coverage Annually:

Life changes such as moving, changing jobs, or buying a new vehicle can impact your insurance needs. Annual reviews of your coverage can help ensure that you have the most appropriate and cost-effective policy based on your current situation.

Frequently Asked Questions

Q: What is the average cost of car insurance in Virginia?

A: As of 2024, the average cost of car insurance in Virginia is approximately $60 per month for minimum coverage and $133 per month for full coverage.

Q: How can I get a free car insurance quote?

A: Most insurance companies provide free online quotes on their websites. You can also reach out to an insurance agent for personalized quotes.

Q: What are some common car insurance discounts in Virginia?

A: Common discounts available in Virginia include those for good drivers, multi-car households, safe driving, bundling, and student discounts.

Q: Is it better to have minimum or full coverage car insurance in Virginia?

A: The best type of coverage depends on your individual needs and financial situation. While minimum coverage meets legal requirements, full coverage provides more extensive protection in case of an accident. However, some drivers may find minimum coverage a viable option based on their financial circumstances.

Conclusion

Finding the best car insurance in Virginia requires a thorough understanding of your needs, diligent comparison of quotes, and taking full advantage of available discounts. By following the tips outlined in this guide, you can secure affordable coverage that protects both you and your vehicle. Start comparing car insurance quotes today to discover the best rates and coverage tailored to your unique situation. Don’t let high insurance premiums prevent you from obtaining the protection you deserve.

Leave a Reply