Owning multiple pets is amazing, but let’s face it—veterinary bills can add up fast. Finding the best pet insurance for your furry family is more important than ever. This guide breaks it down, helping you compare policies, weigh your options, and find coverage that works for your budget.

Toc

Why Multi-Pet Vet Care Costs So Much

Pets bring endless joy, but they also come with big financial responsibilities. If you’ve got more than one, those vet bills can quickly get out of hand.

Rising Vet Costs Are No Joke

Did you know the average yearly vet bill for one pet is around $1,200? And it can climb past $2,000 depending on treatments. Over the last decade, routine procedures have gotten much pricier. Spaying a female dog now costs between $300 and $800, compared to $200 to $500 ten years ago. Dental cleanings? Used to be around $300—now they’re anywhere from $500 to $1,200.

Now multiply those numbers by the number of pets in your home. Say you have two dogs and they both need surgery for hip dysplasia. You’re looking at an $8,000 bill, easy. That’s where the best pet insurance for multiple pets becomes a lifesaver—literally and financially.

Tackling the Financial Load of Multi-Pet Life

Each new pet you adopt doubles (or triples!) your responsibilities—and your expenses. Routine care like vaccines, dental cleanings, and check-ups might not seem like much at first. But for four pets, an annual $150 check-up per pet quickly adds up to $600. Without insurance, those bills can feel overwhelming.

Pet insurance for multiple pets can help you breathe easier. These plans cover accidents and illnesses, so when something unexpected happens, you’re not in a financial panic. Instead, you can focus on keeping your furry crew happy and healthy, without the constant worry about how to pay for it.

Investing in a good pet insurance plan isn’t just about saving money—it’s about peace of mind. And when you’ve got a house full of wagging tails or purring companions, that peace of mind is priceless.

Multi-Pet Insurance: How to Save Big

Got more than one furry friend? Pet insurance can get expensive fast. Luckily, many providers offer multi-pet discounts to help cut costs. Here’s what you need to know to get the most bang for your buck.

Multi-Pet Discounts: A Smart Way to Save

Some insurance providers, like Pumpkin Pet Insurance and Spot Pet Insurance, offer discounts of 5% to 10% when you insure multiple pets. Sounds great, right? Just keep in mind that not all plans qualify, and some discounts might be smaller than you expect. Always ask about multi-pet policies when shopping around to make sure you’re getting the best deal.

Choose the Right Coverage for Your Pets

When insuring multiple pets, it’s important to pick the right kind of coverage. Here’s the breakdown:

- Accident-Only Policies: Cheaper and covers unexpected injuries like broken bones or poisoning. Great if your pets are young and healthy, but don’t expect it to cover illnesses.

- Accident and Illness Policies: Covers accidents, plus illnesses and chronic conditions. Costs more, but it’s worth it if your pets are older or have health issues.

Pro tip: Look at how deductibles and reimbursement rates affect your premiums. A higher deductible means lower monthly payments but higher out-of-pocket costs when you file a claim.

Adjust Your Deductible to Save More

Want to save on premiums? Consider raising your deductible (also called excess). Sure, you’ll pay more out of pocket for a claim, but you can slash your monthly costs.

For example, raising your deductible from $500 to $1,000 might save you $20 or more each month. Over time, that adds up—especially when you’re insuring more than one pet. If your pets don’t need frequent vet visits, this could be a smart move for your wallet.

At the end of the day, multi-pet insurance can be a lifesaver for your budget if you know how to navigate the options. Shop around, ask questions, and find the plan that works best for you and your pack.

1. https://fordlangha.com.vn/mmoga-the-best-car-insurance-in-nc-affordable-coverage-for-young-drivers

Best Pet Insurance for Multiple Pets in the USA

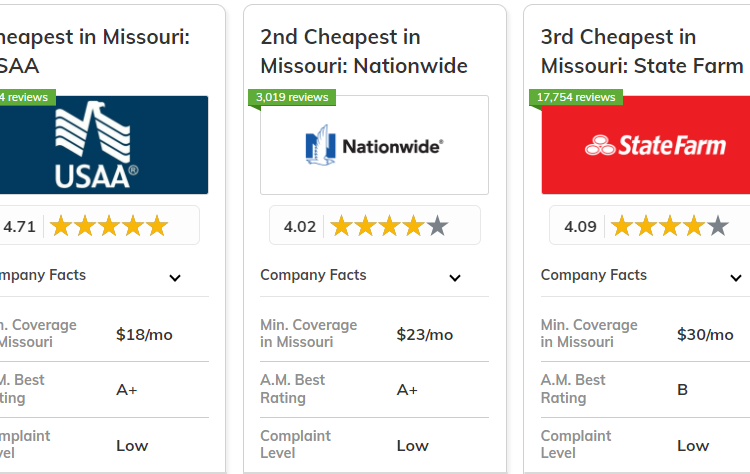

Looking for the best pet insurance for multiple pets? You’re not alone. Plenty of options out there, but some really stand out for their features and customer reviews. Here’s a quick breakdown of top picks, plus a look at their average annual premiums.

Pumpkin Pet Insurance

Pumpkin is a solid choice if you want comprehensive coverage for all your furry friends. They’ve got plans tailored for multiple pets, with perks like unlimited annual benefits and customizable options. People on Reddit often rave about their no-hassle claims process and top-notch customer service.

Why Choose Pumpkin?

- Unlimited Annual Benefits: No caps on how much you can claim in a year.

- Preventative Care Coverage: Covers routine stuff like vaccines and dental cleanings.

- Customizable Plans: Adjust coverage to fit your pet’s specific needs.

What’s the Cost? About $1,200 per year for one pet.

Spot Pet Insurance

Spot is all about flexibility. You can tweak your coverage to suit each pet, picking your reimbursement rate and annual limits. It’s especially handy if you’ve got pets with different needs. Reddit users generally like Spot’s fast claims process and good customer support.

Why Go with Spot?

- Customizable Plans: Pay only for what you need based on your pet’s health.

- Fast Claims Processing: Quick reimbursements, so you’re not left waiting.

- Multi-Pet Discounts: Save more when insuring multiple pets.

What’s the Cost? Around $1,100 per year for one pet.

Bottom line: If you’ve got more than one pet, these providers make it easier to get the coverage you need without breaking the bank. Think about what matters most—cost, benefits, or flexibility—and pick the one that fits your family best.

Lemonade Pet Insurance

Lemonade Pet Insurance is making waves for its simple digital platform and quick claims process. They cover accidents and illnesses, with optional add-ons for things like preventative care. Pet owners love the convenience of their mobile app—it makes filing and tracking claims a breeze. On Reddit, users often praise Lemonade for its affordable pricing and ease of use, which makes it a great option if you’re hunting for the best pet insurance for multiple pets.

Why Lemonade Stands Out:

- Streamlined App Experience: Everything—from signing up to claims—is handled through their app.

- Clear Pricing: Their AI gives you instant quotes, so you can easily compare options.

- Social Impact: Lemonade donates leftover premiums to charity, a nice perk for socially conscious pet owners.

Average Annual Premium: Around $1,050 per pet.

Embrace Pet Insurance

If you’re looking for flexibility and solid coverage, Embrace Pet Insurance has you covered. They’re known for low deductibles and a unique policy that looks at only the last 12 months of medical history when evaluating pre-existing conditions. This makes them a good pick for older pets. Reddit users frequently highlight Embrace’s smooth claims process and helpful customer support.

What Makes Embrace a Good Choice:

- Customizable Deductibles: Pick your deductible to better manage your premiums.

- Pre-Existing Condition Flexibility: Their approach to pre-existing conditions is more lenient than most, which is great for aging pets.

- Wellness Rewards Program: They’ll reimburse you for routine care expenses, which is a nice bonus.

Average Annual Premium: Around $1,250 per pet.

Other Notable Providers

If you’re insuring multiple pets, there are other solid options to consider. Figo and Pets Best stand out for their unique features like unlimited annual benefits and direct vet payments. Here’s what you need to know:

Figo Pet Insurance

3. https://fordlangha.com.vn/mmoga-the-best-car-insurance-in-nc-affordable-coverage-for-young-drivers

5. https://fordlangha.com.vn/mmoga-best-car-insurance-in-arizona-find-affordable-coverage-for-you

- Unlimited Annual Benefits: No annual limits, so you can claim as much as needed.

- Pet Cloud App: Manage your policy, submit claims, and access your pet’s medical records all in one place.

Average Annual Premium: Around $1,300 per pet.

Pets Best Pet Insurance

- Direct Vet Payment: Your vet can get paid directly, cutting down your out-of-pocket costs.

- Comprehensive Coverage: Covers accidents, illnesses, and even routine care, giving you peace of mind.

Average Annual Premium: Around $1,400 per pet.

When it comes to finding the best pet insurance for multiple pets, it all boils down to what matters most to you—affordable pricing, flexible coverage, or standout perks. Take a closer look at these options to see which one fits your needs best!

Dealing with Pre-Existing Conditions and Older Pets

Figuring out how pre-existing conditions impact pet insurance is key, especially when covering multiple pets. Most insurers won’t cover ongoing health issues your pet already has. So, if your furry friend has a chronic condition, don’t expect those treatments to be included.

That said, there’s a bit of wiggle room with some providers. A few might cover certain pre-existing conditions if they’re considered curable and your pet has been symptom-free and untreated for a set time—say, 12 months. If you’ve got older pets, it might make more sense to check out accident-only plans. These plans won’t break the bank and still offer financial protection for unexpected mishaps.

Smart Tips for Insuring Older Pets

- Look for flexible policies. Some insurers are more forgiving when it comes to pre-existing conditions. Do your homework and find one that works for your situation.

- Check out accident-only plans. These are often cheaper and can still save you in case of surprise accidents, even if your pet has health issues.

Bottom line? For older pets, focus on policies that offer flexibility with pre-existing conditions. Accident-only plans can also be a solid, budget-friendly option. This way, you’ll make sure your pets get the care they need without stressing your wallet.

Tips for Choosing and Managing Multi-Pet Insurance

Focus on Preventative Care

Want to save on vet bills in the long run? Focus on preventative care. Regular check-ups, vaccinations, and spaying or neutering can help your pets avoid big health issues later—and keep your insurance premiums in check. Many providers, like Lemonade Pet Insurance, even offer wellness plans to cover these routine costs. It’s an easy way to work preventative care into your plan without breaking the bank.

Shop Around for the Best Deal

Don’t just grab the first policy you see. Take the time to compare quotes from several providers. Each company offers different pricing, coverage, and discounts, so doing your homework can help you snag the best pet insurance for multiple pets. Pay attention to things like coverage limits, deductibles, and reimbursement rates to make sure you’re getting the most bang for your buck.

Know the Fine Print on Waiting Periods and Claims

Here’s the deal—most pet insurance policies have waiting periods before coverage actually kicks in. Accident coverage might be instant, but illness coverage could take 14 days or more. Knowing these details upfront can save you from unexpected surprises.

And about claims? Usually, you’ll pay the vet first, then file a claim for reimbursement. Some providers make life easier by paying the vet directly, so check how the claims process works with your provider. It’s worth understanding how to handle this before you actually need to use it.

Pick the Right Coverage for Your Pets

Not every pet needs the same kind of insurance. Got young, healthy pets? An accident-only plan could do the trick. But if you have senior pets or those with chronic issues, a more comprehensive plan is probably the way to go. Think about what your pets really need, and choose a plan that fits their health (and your budget)

Conclusion

Finding the best pet insurance for multiple pets doesn’t have to be overwhelming. This guide broke down the essentials: understanding costs, comparing top providers like Pumpkin, Spot, Lemonade, and Embrace, and picking a plan that works for your budget and your furry crew. The takeaway? Protect your pets without emptying your wallet. Start comparing quotes now and make sure your pets get the care they deserve. Don’t wait for a crisis—planning ahead means peace of mind and fewer financial surprises.

With the right plan in place, you can relax and enjoy your pets without stressing about surprise vet bills. Focus on preventative care, know what your coverage includes, and build a plan that fits your situation. Do a little research, weigh your options, and pick the policy that feels right. Taking these steps now means your pets stay happy and healthy—and you stay worry-free.

Leave a Reply