For many young drivers, the excitement of getting behind the wheel can quickly turn into a financial headache when faced with high car insurance premiums. Young drivers, especially those under 25, are often hit with hefty quotes due to their lack of experience on the road. This guide aims to equip young drivers with practical advice and insights into finding the best cars for cheap insurance, empowering them to make informed vehicle choices that align with their budget and safety needs.

Toc

Why Car Insurance is More Expensive for Young Drivers

Car insurance tends to be more costly for young drivers, particularly those aged 16 to 19, who are statistically more prone to accidents. A 2023 study by the National Highway Traffic Safety Administration (NHTSA) revealed that drivers in this age group have a crash rate nearly three times higher than that of drivers aged 30-59. This increased risk directly translates to higher insurance premiums, leaving many young drivers feeling financially pressured.

Several factors contribute to these elevated rates, including:

Lack of Experience

Young drivers lack the experience that older, more seasoned drivers possess, making them more susceptible to making errors on the road. Without a solid foundation in driving skills and situational awareness, their reaction times to unexpected events may be slower, leading to an increased likelihood of accidents. Insurance companies recognize this heightened risk and, as a result, see young drivers as a higher liability, thus charging them more for coverage. To mitigate these costs, young drivers are often encouraged to take additional driver training courses, maintain a clean driving record, and consider safer, less sporty vehicles, as these can help lower their insurance premiums over time.

Risk-taking Behavior

Teenagers and young adults are more prone to engage in risky behaviors while driving, such as speeding, distracted driving, and not wearing seat belts. Developing maturity and responsible driving habits is key; insurance companies often factor in the statistical likelihood of such behaviors when determining rates for young drivers. Additionally, nighttime driving and weekend travel, when young drivers are most likely to be on the road, are periods associated with higher crash rates. By understanding these behaviors and their impact on insurance costs, young drivers can take steps to demonstrate responsible driving and potentially earn discounts or lower rates from their providers.

Driving Record

A young driver’s driving record also plays a significant role in determining their insurance premiums. A clean driving record with no accidents or traffic violations can lead to lower rates, while a history of speeding tickets and collisions can result in higher costs. It is crucial for young drivers to understand the importance of safe and responsible driving from the start, as any mistakes on the road can have long-term financial consequences.

Choice of Vehicle

The type of vehicle a young driver chooses can significantly impact their insurance premiums. Sports cars, high-performance vehicles, and cars with high theft rates often come with increased insurance costs due to their association with higher risk levels. Insurance companies tend to charge more for these vehicles as they are statistically more likely to be involved in accidents or stolen. Instead, young drivers should consider more modest, reliable vehicles with advanced safety features. Cars that have high safety ratings and are equipped with airbags, anti-lock brakes, and other modern safety technologies can often lead to reduced insurance costs. It’s important for young drivers to research and select a car that balances both affordability and safety, helping to lower their insurance rates while ensuring a secure driving experience.

Additional Discounts

Many insurance providers offer a variety of discounts that can benefit young drivers looking to save money on their premiums. Good student discounts are commonly available to those who maintain a certain GPA, reflecting responsibility both in academics and potentially on the road. Completing driver education courses, such as defensive driving programs, can also lead to discounts, as they indicate a commitment to becoming a safer driver. Some insurers provide discounts for young drivers who agree to telematics programs, where driving behavior is monitored through a digital device. These programs can reward safe driving habits with lower rates. By exploring and taking advantage of these discounts, young drivers can reduce their insurance expenses and manage their budgets more effectively.

Factors Influencing Young Driver Insurance Rates

Several elements can significantly influence the cost of car insurance for young drivers. Let’s break them down to help you make savvy decisions when selecting your vehicle and coverage.

Driving Record

Your driving history is one of the most significant factors affecting your insurance rates. A clean record with no accidents, speeding tickets, or DUI convictions is essential for keeping premiums in check. A 2022 study by the Insurance Information Institute (III) found that drivers with a single at-fault accident could see their premiums increase by an average of 40%. This emphasizes the importance of safe driving and avoiding accidents.

Credit Score

Did you know that your credit score could impact your insurance rates? Many insurance companies view a good credit score as an indicator of responsible behavior, which can lead to lower premiums. If your credit score isn’t where you’d like it to be, consider taking steps to improve it—like paying bills on time and reducing debt.

Location

Where you live plays a significant role in determining your insurance rates. Urban areas often have higher premiums due to increased traffic congestion, higher accident rates, and a greater likelihood of vehicle theft. If you’re in a bustling city, brace yourself for potentially higher insurance costs.

4. https://fordlangha.com.vn/mmoga-the-best-pet-insurance-for-multiple-pets-a-practical-guide

5. https://fordlangha.com.vn/mmoga-best-car-insurance-in-arizona-find-affordable-coverage-for-you

Vehicle Type

The car you drive can make a world of difference when it comes to insurance rates. Cars with excellent safety features, low repair bills, and lower theft risks often result in more affordable insurance. Conversely, flashy sports cars and luxury models usually come with inflated rates.

Coverage Level

Choosing the right level of coverage is crucial. While it may be tempting to go for the minimum required coverage to save money, it’s essential to consider what you truly need. Higher coverage levels, such as comprehensive and collision insurance, generally lead to higher premiums, so assess your options carefully.

Deductible

Your deductible is the amount you pay out-of-pocket before your insurance kicks in during a claim. Opting for a higher deductible can lower your monthly premium, but be prepared to pay more if an accident occurs. Weigh the pros and cons carefully to find the right balance for your budget.

Bundling

Combining your auto insurance with other policies—like renters or homeowners insurance—can lead to discounts from many providers. If you have multiple insurance needs, bundling is a smart strategy to save money.

Understanding these factors can empower young drivers to make informed decisions when purchasing a vehicle and selecting insurance coverage.

Best Cars for Cheap Insurance: Choosing the Right Ride

When searching for the best cars for cheap insurance, focus on vehicles that offer a mix of safety, reliability, and affordability. These attributes not only contribute to lower insurance premiums but also provide peace of mind on the road.

Top 10 Most Affordable Cars for Young Drivers

- Honda Civic: This perennial favorite combines safety, reliability, and affordability. The Honda Civic’s strong reputation for dependability and lower repair costs makes it a top choice for young drivers.

- Subaru Outback: With standard all-wheel drive and a stellar safety record, the Subaru Outback is a practical and affordable option for young drivers who value safety.

- Toyota Corolla: Known for its reliability, the Toyota Corolla is a budget-friendly compact car with an excellent safety track record, making it a fantastic choice for young drivers.

- Hyundai Elantra: This compact sedan boasts impressive safety features, a user-friendly design, and affordable insurance rates, making it a smart pick for budget-conscious young drivers.

- Kia Soul: With its unique style and practical design, the Kia Soul is a versatile option that offers affordability and lower insurance rates.

- Mazda3: This compact car offers a blend of style, efficiency, and reliability, often coming with lower insurance premiums for young drivers.

- Subaru Impreza: Like its sibling the Outback, the Subaru Impreza is known for its all-wheel drive and impressive safety ratings, making it an ideal choice for young drivers.

- Honda Accord: A midsize sedan known for reliability and safety, the Honda Accord is a practical and affordable option for young drivers seeking comfort and dependability.

- Toyota RAV4: As a compact SUV with a strong safety reputation and reliable performance, the Toyota RAV4 provides young drivers with a spacious option without exorbitant insurance costs.

- Nissan Sentra: This compact sedan offers a compelling mix of affordability, fuel efficiency, and reliable safety features, making it a budget-friendly choice for young drivers.

Avoiding Cars with High Insurance Rates

While the vehicles listed above are ideal for keeping insurance costs low, it’s essential to avoid certain car types that tend to carry higher premiums for young drivers.

- Sports Cars: High-performance vehicles, like sports cars, often come with inflated insurance rates due to their increased risk of speeding and reckless driving.

- Luxury Cars: Expensive luxury vehicles typically have higher insurance costs because of their elevated repair and replacement expenses.

- High-Performance Models: Cars with powerful engines and advanced features can lead to increased insurance premiums for young drivers.

By steering clear of these types of vehicles and focusing on practical, reliable options, young drivers can significantly cut their car insurance costs.

Saving Money on Car Insurance

In addition to choosing the right vehicle, there are several strategies young drivers can employ to lower their car insurance premiums:

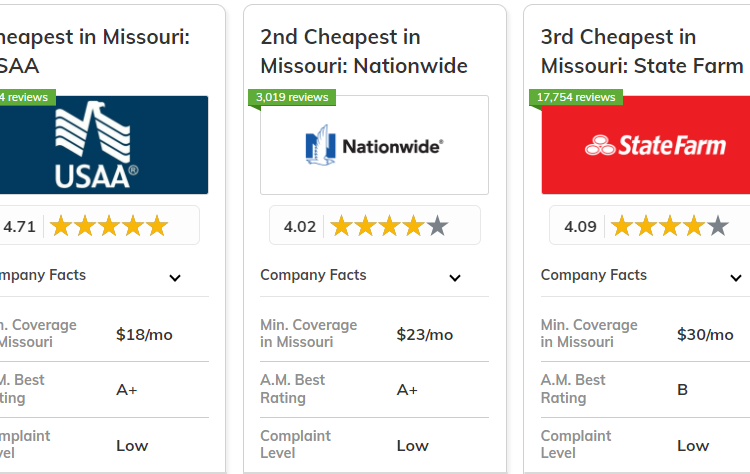

Shop Around for Quotes

Don’t settle for the first quote you receive. Compare rates from multiple insurance providers to ensure you’re getting the best deal. Insurance rates can vary significantly, so it’s worth your time to explore your options.

Take Advantage of Discounts

Many insurance providers offer discounts for young drivers. Look for opportunities such as good student discounts, safe driver discounts, and multi-car discounts to help reduce your insurance costs.

Consider Usage-Based Insurance

Telematics-based insurance programs that track your driving habits are becoming increasingly popular. These programs can offer discounts based on safe driving behavior, such as avoiding speeding or hard braking. If you’re a responsible driver, this option could save you money.

Increase Your Deductible

Opting for a higher deductible can help lower your monthly insurance costs. Just be mindful that you’ll need to pay more out-of-pocket if you file a claim, so choose a deductible that fits your financial situation.

1. https://fordlangha.com.vn/mmoga-best-car-insurance-in-arizona-find-affordable-coverage-for-you

2. https://fordlangha.com.vn/mmoga-the-best-car-insurance-in-nc-affordable-coverage-for-young-drivers

3. https://fordlangha.com.vn/mmoga-the-best-pet-insurance-for-multiple-pets-a-practical-guide

Maintain a Clean Driving Record

This one’s a no-brainer: safe driving habits are essential. Avoid accidents, speeding tickets, and other traffic violations to keep your insurance rates as low as possible.

Frequently Asked Questions

Q: What are the best cars for cheap insurance for young drivers with a bad driving record?

A: Finding cheap insurance for young drivers with a poor driving record can be tricky. However, models with solid safety features and lower repair costs, like the Honda Civic or Subaru Outback, may still be more affordable options compared to high-performance or luxury vehicles.

Q: How can I get the best car insurance quotes as a young driver?

A: To secure the best car insurance quotes, shop around and compare rates from multiple insurers. Don’t forget to leverage any available discounts, such as good student or safe driver discounts. Keeping a clean driving record and maintaining a good credit score can also help you land more affordable rates.

Q: What are the minimum car insurance requirements in my state?

A: Minimum car insurance requirements vary by state, so it’s vital to research the specific liability coverage limits for bodily injury and property damage in your area. Some states may also require uninsured/underinsured motorist coverage or personal injury protection (PIP). Familiarizing yourself with your state’s requirements can help you make informed insurance decisions.

Q: What are some tips for young drivers to stay safe on the road?

A: Practicing safe driving habits is crucial. Avoid distractions, follow traffic laws, and maintain a safe following distance. Regularly check your vehicle for maintenance issues, and always wear your seatbelt.

Q: What are the best resources for learning more about car insurance?

A: Websites like the National Association of Insurance Commissioners (NAIC) and Consumer Reports offer valuable information about car insurance. Additionally, consulting with insurance agents can provide personalized insights tailored to your situation.

Conclusion

Finding the best cars for cheap insurance as a young driver is a crucial step in managing the financial responsibilities that come with newfound freedom. By understanding the factors that influence insurance rates, focusing on safe and reliable vehicle choices, and utilizing smart insurance strategies, young drivers can enjoy the open road without breaking the bank. Remember, taking proactive measures, such as maintaining a clean driving record, exploring discounts, and comparing insurance quotes, can go a long way in ensuring you get the most affordable and comprehensive car insurance coverage. With the right approach, young drivers can navigate the world of car insurance with confidence and find the perfect vehicle that fits their budget and driving needs.

Leave a Reply